S-Corp Basics

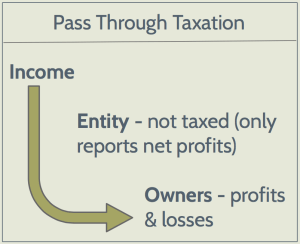

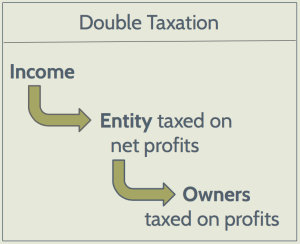

S-Corporations are not technically a distinct entity type. Rather, the term "S-Corp" refers to a type of tax treatment available to corporations and LLCs that meet certain requirements. When a corporation makes an S-Corp election, it will avoid double taxation, which is often viewed as the primary disadvantage of creating a corporation (i.e. a C-Corp). Instead, the corporation will enjoy pass-through taxation. In the context of LLCs, the choice to be taxed as an S-Corp can allow the owners to lower their tax liability in certain situations. To elect to be taxed as an S-Corp, a company must meet strict requirements. These requirements, as well as a brief overview of how an S-Corp election impacts the 4 factors to consider when choosing a business entity, are described below.

S-Corp Requirements

In order to qualify to be treated as an S-Corp for federal tax purposes, the following requirements must be met:

- The entity must be domestic (i.e. formed in the United States);

- The owners (shareholders for corporations, members for LLCs) may only be natural persons (individuals) or certain trusts and estates (i.e. no partnerships, corporations, or other entities);

- The owners must be legal residents of the United States;

- The entity cannot have more than 100 owners;

- The entity can only have one class of ownership; and

- There are certain types of entities that are categorically excluded, including certain financial institutions, insurance companies, and domestic international sales corporations.

The S-Corp election is made by filing a simple form (Form 2553) that must be signed by all owners of the business, and it must be filed no more than two months and 15 days after the beginning of the tax year the election is to take effect. Thus, for a new entity, the election must be filed within two months and 15 days from the date of incorporation in order for the entity to be treated as an S-Corp for the year of incorporation. After the S-Corp election is filed and accepted by the IRS, the entity will continue to be taxed as an S-Corp until that classification is terminated by the IRS, or the entity revokes the election by submitting a simple letter to the IRS.

Limited Liability

The S-Corp election does not impact the limited liability that corporations of all kinds enjoy. Thus, as in a C-Corp or an LLC, the owners of an enterprise that has filed the S-Corp election enjoy limited liability. This means that the individual owners' assets are generally not available to creditors of the enterprise. For more information on limited liability, see this article on why creating a formal entity is beneficial.

Tax Treatment of an S-Corp

As discussed above, the classification of an enterprise as an S-Corp is a classification for tax purposes. When a corporation (i.e. a C-Corp by default) files a Chapter-S Election, then the corporation will be taxed as a pass-through entity, and will avoid the double taxation that C-Corps are subject to by default (for federal income tax purposes). This allows the profits and losses to pass through to the individual shareholders, who claim such profits and losses on their individual tax returns. By contrast, a corporation who has not made the S-Corp election will be subject to double taxation and the net profits will be taxed at the entity level, and then taxed again at the shareholder level. In California, S-Corps are subject to a 1.5% entity level tax on net income.

LLCs can also choose to be taxed as S-corps by "checking the box" to be taxed as a corporation and then filing the Form 2553 to elect to be taxed as an S-Corp.

But LLCs are already pass-through entities, so why would an LLC choose to be taxed as an S-Corp?

This is because S-Corp owners who also provide services to the enterprise have the ability to, when appropriate, split the money they receive into salary and profits. By default, all gross receipts of an LLC taxed as a partnership (the default tax treatment for LLCs) are passed through to the owners as income and are subject to all self-employment taxes. But splitting the total income into salary and profits lowers the overall tax liability of the owners because profits are not subject to certain types of self-employment payroll taxes (specifically, Medicare and Social Security taxes). To receive this favorable tax treatment, the owner-employee must first pay herself a reasonable salary. This is a hot-button issue for the IRS, and the question of whether a salary is reasonable is a fact-specific inquiry. Generally, if the gross receipts of the entity are primarily from the shareholder-employees' own labor, as opposed to the labor of non-shareholder employees or capital and equipment, then such receipts should be included in the salary portion and not in the profit portion. For more information on when compensation is considered reasonable, see this helpful resource from the IRS.

Sources of Funding

As discussed above, businesses taxed as S-Corps can only generally have natural persons as owners and can only have one class of ownership. For this reason, S-Corps will not be able to receive funds from professionals investors such as VCs, impact investors, or angels who seek a preferred class of stock and invest as an entity, rather than as individuals. For this reason, an enterprise seeking any form of institutional investment should either not make the Chapter S Election, or revoke the Election (through a simple letter to the IRS) prior to seeking funding. Other forms of funding, such debt or money from family and friends are available to entities taxed as S-Corps.

At times, it may make sense for a young startup to operate as an S-Corp until it is ready to raise funding from professional investors, who will generally require that the entity be a C-Corp, at which point it can easily revoke the Chapter S election and go back to the default of operating as a C-Corp. By doing this, founders can claim the early losses associated with getting the enterprise off the ground on their individual tax returns to decrease their tax basis. There are some tradeoffs with this approach, so it should only be followed after careful consideration with the help of tax and legal counsel.

Formalities

As discussed above, entrepreneurs seeking to be taxed as an S-Corp need to first setup their entity as either an LLC or a C-Corp and then file Form 2553. Because the S-Corp election is only an election for tax purposes, the governance requirements and other formalities of an S-Corp entity are those that attach to the underlying entity type.

S-Corp Election for Benefit Corporations and Flexible Purpose Corporations

The S-Corp election can be filed by social enterprises formed as a benefit corporation or flexible purpose corporation. By default, these entities are taxed as C-Corps, but as is the case with other C-Corps, if the enterprise can meet the requirements listed above, then it can choose to file the Chapter S Election to receive pass-through taxation.

Contact us to discuss whether it makes sense for your enterprise to elect to be taxed as an S-Corp.

DISCLAIMER: The information in this article is provided for informational purposes only and should not be construed or relied upon as legal advice. This article may constitute attorney advertising under applicable state laws.

Categories

Recent Posts

- Negotiating Side Letters in Pre-Seed and Seed Rounds

- Key Terms: SAFEs & Convertible Notes for Pre-seed Funding

- A Guide To Raising Money From Accredited Investors

- Startup 101: Overview of Pre-Seed and Seed Investment

- SPZ Legal's Commitment to Social Impact with Pledge 1%

- Issuing Equity to Service Providers? A Guide to Equity Incentive Plans for Startups.

- A Guide to Navigating the New Beneficial Ownership Information Reporting Requirements

- Unveiling the Power of Venture Debt: A Legal Guide for Startup Founders