Factors to Consider When Choosing a Business Entity

We are often asked "what is the best entity type?" There really is no one-size-fits-all answer because each entity may be more or less beneficial for any given enterprise. Rather, it is important for entrepreneurs to consider various factors when choosing a business entity.

The entity type should not dictate the plans for the business. Rather, entrepreneurs shoud pursue their goals and find the entity type that fits their plans.

In a separate post we discuss why it is necessary to incorporate a business as opposed to simply operating as a sole proprietorship or general partnership. And take a look at this article regarding where to incorporate your business and why so many businesses incorporate in Delaware.

Below are several important factors to consider when choosing a business entity.

Limited Liability

The first factor to consider when choosing a business entity is limited liability. Without limited liability status, creditors of the business can access the personal assets of the business owners. Choosing the right entity type will limit personal liability for the owners of your business up to the extent of their investment. For example, if a person wins a judgment in a lawsuit against a business without any limitation on liability, the individual owners' assets may be accessed to pay off the judgment if the business does not have adequate funds. Limited liability is often thought of as the primary reason for establishing a "formal" business entity (i.e. a business entity that requires filing paperwork with a state).

Moreover, in a partnership without limited liability, all partners are jointly and severally liable for the acts of the other partners. This means that if one partner acts negligently, the personal assets of all other partners may be reached to satisfy the liability.

|

Limited Liability |

Personal Liability |

|

|

Assets Available to Creditors |

|

|

|

Business Entity Types |

|

|

NOTE: there are circumstances where personal liability of owners is not eliminated even if the business is organized as an entity that generally enjoys limited liability. For example, if an owner is personally negligent or engages in fraudulent acts, limited liability will not protect that owner from personal liability. However, limited liability would still protect co-owners who did not participate in such acts.

Tax Considerations

There are two general ways in which businesses are taxed depending on the entity type. (Note that there are additional tax nuances of each entity type that should be considered when choosing a business entity, but these nuances are beyond the scope of this overview.)

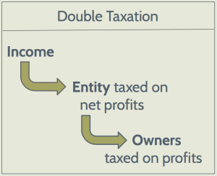

Double Taxation (Federal Taxes)

By default, corporations are taxed at the entity level on net profits and then individual owners' profits (i.e. dividends) are taxed again at the personal level. This is known as "double taxation" and is often considered to be a negative factor of choosing to organize your business as a corporation. However, in certain situations, the business can "zero out" the earnings of the corporation such that there are no net profits left to be taxed at the corporate level. Additionally, if certain requirements are met, corporations can make the Chapter S Election by filing Form 2553 (and become an "S-Corp") to avoid double taxation.

By default, corporations are taxed at the entity level on net profits and then individual owners' profits (i.e. dividends) are taxed again at the personal level. This is known as "double taxation" and is often considered to be a negative factor of choosing to organize your business as a corporation. However, in certain situations, the business can "zero out" the earnings of the corporation such that there are no net profits left to be taxed at the corporate level. Additionally, if certain requirements are met, corporations can make the Chapter S Election by filing Form 2553 (and become an "S-Corp") to avoid double taxation.

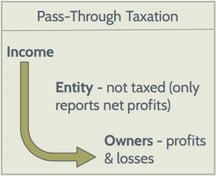

Pass-Through Taxation (Federal Taxes)

The alternative to double taxation is "pass-through taxation" (also referred to at times as "partnership taxation"). When pass-through taxation applies, there is no entity level tax on net profits. Rather, the profits and losses "pass through" to the individual owners and are reported on the owners' individual tax returns. This is generally considered to be a benefit of choosing a non-corporate entity such as LLC or making the Chapter S Election when choosing a business entity.

The alternative to double taxation is "pass-through taxation" (also referred to at times as "partnership taxation"). When pass-through taxation applies, there is no entity level tax on net profits. Rather, the profits and losses "pass through" to the individual owners and are reported on the owners' individual tax returns. This is generally considered to be a benefit of choosing a non-corporate entity such as LLC or making the Chapter S Election when choosing a business entity.

California State Taxes

Enterprises other than sole proprietorships and general partnerships that "do business" in California (even if incorporated out of state) are subject to franchise taxes by the California Franchise Tax Board. The minimum franchise tax for most business entities in California is $800 per year, but see the articles on the individual business types for taxation nuances of each business entity. We often hear that this $800 minimum annual tax is the reason that some owners decide to stick with a sole proprietorship or general partnership when choosing a business entity.

Anticipated Sources of Funding

Equity Funding

If you plan to seek private equity funding for your business (such as angel investment, venture capital, or other forms of equity funding), then the corporate form will likely be preferred by investors. While it is certainly possible to structure LLC distributions in a way that mimics corporate shares, equity investors tend to be more comfortable with the corporate form for several reasons.

First, LLCs can be structured in many ways and the governing documents of an LLC can be changed to alter the structure. But corporate shares are governed by statute and, therefore, give more predictability to investors.

Second, corporate shares are generally considered to be a more liquid asset that is easier for an investor to transfer.

Third, investors are simply more familiar with corporate share transactions based in part on the fact that there is significant case law governing corporate transactions and much less law surrounding LLC ownership interests.

Impact Investment and Socially Responsible Consumers

If you plan to establish a social enterprise that will seek impact investment (i.e. investment from sources seeking a measurable social or environmental benefit in addition to a financial return), setting up your business as a benefit corporation or flexible purpose corporation can help to demonstrate a commitment to a social and/or environmental mission. Similarly, if you plan to market your products or services to socially responsible consumers, incorporating as a benefit corporation or flexible purpose corporation demonstrates your commitment to conducting business for a greater good beyond profits.

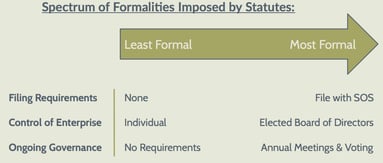

Formalities

Each entity type has various formalities imposed by statute that should be considered when choosing a business entity. These range from practically no formalities in the case of sole proprietorships and general partnerships to extensive ongoing requirements required of corporations. The formalities imposed on various entities include, for example:

- whether or not the business must file paperwork with a state to become established and to report information on an ongoing basis,

- varying meeting requirements (including required meetings with formal notice), and

- governance requirements (including processes for choosing who is in control of the business).

The LLC is often thought of as the entity that provides the most flexibility in terms of formalities while still enjoying limited liability.

Contact us to discuss these factors to help you choose a business entity that best fits your goals.

DISCLAIMER: The information in this article is provided for informational purposes only and should not be construed or relied upon as legal advice. This article may constitute attorney advertising under applicable state laws.

Categories

Recent Posts

- Negotiating Side Letters in Pre-Seed and Seed Rounds

- Key Terms: SAFEs & Convertible Notes for Pre-seed Funding

- A Guide To Raising Money From Accredited Investors

- Startup 101: Overview of Pre-Seed and Seed Investment

- SPZ Legal's Commitment to Social Impact with Pledge 1%

- Issuing Equity to Service Providers? A Guide to Equity Incentive Plans for Startups.

- A Guide to Navigating the New Beneficial Ownership Information Reporting Requirements

- Unveiling the Power of Venture Debt: A Legal Guide for Startup Founders